Part of ‘adulting’ is to purchase insurance for yourself and your family. As the sole bread winner for my family, there was significant risk in a scenario in which I could no longer work or provide for my family. And this becomes readily apparent after making the decision to move to Thailand; if I were to get into a major car accident here, would I have the financial means to weather the associated medical costs and care for my family in the mean time? Or given my heavy travel schedule – going to >10 countries last year – would I have proper medical attention in a foreign country outside of Thailand?

This post discusses how I evaluated health / medical insurance options for my family living here in Thailand – and outlines why I selected the insurer that I did: Cigna for our first year and Allianz Care for our current policy.

Considering Your Medical Needs

Routine medical costs are very affordable in Thailand. For example, I complete a comprehensive annual medical check up (with x-rays, ultrasound, urine sample, etc.) at a modern facility here in Chiang Mai for 4,200 THB (~$120). And for doctor visits for me and my family, I have paid generally 500 THB (~$14) for diagnosing common illnesses like flu, sinus congestion, etc. These are not the medical costs to be concerned about while living abroad in Thailand.

Inpatient costs – hospitalizations, major surgeries, chronic illness treatment, etc – are going to run the risk of impacting your financial well-being. We’re not talking hundreds of thousands of dollars in medical bills like in the U.S. – but nonetheless, if you are mini-retired, absorbing $100,000 of medical costs would mean taking it on the chin. That’s where medical insurance is important.

Therefore, I limited my medical insurance needs to only inpatient coverage. Typically, outpatient coverage is a supplemental package you can add to your core inpatient coverage – but none of my family members anticipate the need for outpatient care. We also excluded office fees, diagnostics (e.g., x-rays) and annual check ups for the reason listed above: they are affordable to pay out of pocket. If the core inpatient plan covered these costs, great – but it wasn’t what I was focused on with my search.

The last thing worth mentioning is considering your geographic coverage (outside Thailand), i.e., how often you will be traveling outside Thailand. My family and I take at least three trips outside Thailand during the year – spring break, summer, and winter – and like I mentioned before, I travel extensively outside Thailand throughout the year, so it’s important to have wide geographic coverage.

Evaluating Insurance Options

There were five criteria I used to evaluate health insurance:

And I considered five different insurers, each providing medical coverage in Thailand and with English speaking staff (in alphabetical order):

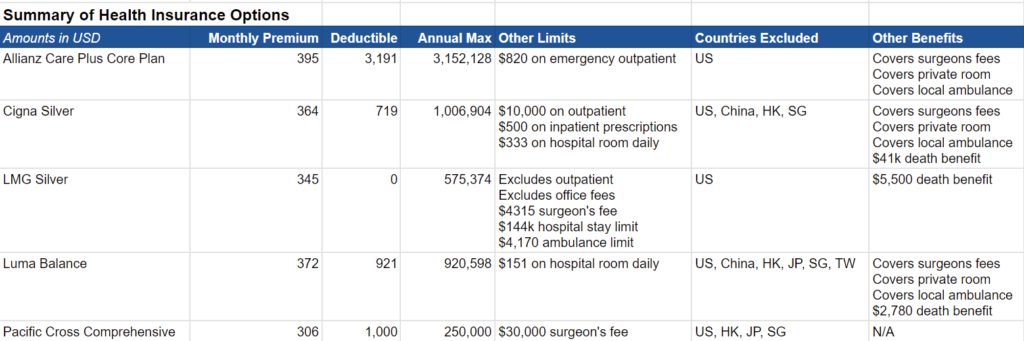

See below for the summary of my evaluation of each option, organized in a table:

Why I Chose Cigna and Allianz

Luma was actually the clear winner among the choices. Luma’s Balance plan has a low deductible (relative to other options), a high annual max, few exclusions, and fully covers what our family potentially needs in the case of emergencies: ambulances to the hospital, fees associated with surgeries, and private rooms for inpatient stays. Luma also provided me great service: transparent documentation (in English), responsive sales member, and full answers to my questions. The only drawback was the exclusion of China, Hong Kong, Japan, Singapore and Taiwan from coverage – which could have materially affected us because we spent family vacations in Japan, Singapore and Taiwan in our first year abroad. Geographic exclusions aside, we went ahead and applied for coverage with Luma, but their underwriting team was concerned with one of our family member’s health history so concluded that they could not cover this member. So rather than split up our family’s coverage, we looked at other options.

For our first year in Thailand, I chose Cigna. It’s Silver plan had the lowest deductible, a high annual max, and also had full coverage of ambulances, surgeries, and private rooms. In contrast with Luma, Cigna provides (some) coverage for outpatient and also includes Japan and Taiwan, but does have some limits on inpatient prescriptions and hospital room rates. We felt these helped offset one another. So we applied for Cigna’s Silver plan and received approval. We were happy Cigna members until we received a letter in the mail in June (only a month prior to renewal) that the global insurer Chubb acquired Cigna’s Asia Pacific insurance business, and as a result, would terminate our family’s coverage. I was surprised to see that Chubb would not honor the terms of Cigna’s Silver plan, so opted to look into other insurance options.

For our second year in Thailand, I chose Allianz. It’s Care Plus – Core Plan has a slightly higher premium than Cigna’s and a the highest deductible among all options. However, Allianz offsets these costs with: an annual max exceeding $3 million; full coverage of ambulances, surgeries, and private hospital rooms; and inclusion of every country globally outside of the U.S. Suffice it to say, coverage with Allianz gives me some peace of mind that our family would be covered under a variety of different scenarios. I have also found Allianz’s customer service to be very responsive as well as their online portal easy-to-use (e.g., uploading receipts, explanations by their underwriting staff).

Summary

If you are planning to move or are currently living in Thailand, then I encourage you to spend some time researching the right health insurance options for you and your family. Getting in a medical emergency would not only greatly affect your mental and physical well-being, but also would materially impact your finances (and therefore your mini-retirement plans), so health insurance helps hedge against those downside risks. I hope you find this post helpful in giving you a couple of considerations in evaluating medical plans – as well as some names of reputable global insurers – so that you can support you and your family’s peace of mind while living the good life here in Thailand and traveling across Asia and beyond.

~Lester T